What We Learned from Selce's Last Two Share Offers

As part of a Community Energy London event in December, Selce Co-Chair Kate Parker was interviewed by the Community Energy Investor’s Club.

With their permission, here we publish the interview in full, in case it is useful to sister community energy groups, or current and future investors and members.

Our sixth community share offer, and second devoted to energy efficient LED lighting is launching soon – register your interest here to be the first to hear when it goes live.

How much lead-in time did you promote the share offers over?

For our 2025 solar share offer, we made good use of an unexpected additional six month plus lead time, as a result of delays in getting site lease agreements signed with two local authorities and consequently uncertainty over which sites would be included in the share offer.

We mentioned that the share offer was on its way a few times in our newsletter, but also prepared the way somewhat with an interview with CE Investors Club talking about who and why people invest, and another piece for new potential members, explaining the share offer process from scratch. Our Festival of Retrofit events in November 2024 and March 2025 also helped pave the way.

Just as a general point, the process of building share offers, particularly solar, has been really tough with very little that is within Selce’s control.

Without pro-active and engaged local authorities this will always be a difficult and uncertain process.

Some of the issues Selce and other community energy cooperatives face in working effectively with local authorities to get sites to a point where a share offer can be launched, and which cause frequent delays and uncertainty, were considered by the Royal Borough of Greenwich’s Cooperative Commission and are addressed in their recommendations.

The Greenwich Community Energy fund launched in December, so one of those recommendations has already been actioned.

For the 2024 share offer, which focussed on LED lighting rather than solar, we had a shorter lead time – around one month – but the offer was promoted at a solar & LED-themed walking tour Selce put on as part of London’s Open House Festival, which was well attended and attracted people new to Selce.

Did you get any match funding? If so, from whom?

For 2025’s solar share offer, no – but Cooperatives UK Booster Fund award supported our marketing and development on it.

For 2024’s LED share offer, we received support from the Green Britain Foundation.

Why didn’t you seek Community Shares Standard Mark?

For the 2025 share offer, we were very keen and committed to seek the Community Shares Standard Mark, both as a quality mark of our share offer, and to offer access to matched equity through the Cooperatives UK.

Staff and directors put in a significant amount of time and effort towards this. The level of documentation was significantly higher and more resource intensive than when Selce last applied.

In particular, the requirements for financial modelling and forecasts were challenging – Selce had dedicated models for each of our four previous share offers over the last decade and we needed to present consolidated information. After several months of work and close engagement with the application assessor, the final step in order for the application to gain approval required that the detailed consolidated model that we had compiled reflected the actual share offer performance to date and aligned with historic submitted company accounts, this was challenging as the accounts also include our grant funded fuel poverty work.

Staff and board members had to take the tough decision that it was not possible or the right priority for Selce’s resources to focus on trying to complete this exercise to meet the final application deadline at this point.

The huge amount of work done on the application including consolidating the share offer models has been valuable, we were just unable to complete what was required for the financial models within the timescale and resource limits.

At the time of the application Selce did not have a staff resource dedicated to finance, and our fundraiser was managing multiple priorities including critical grant applications for our energy advice team. Both of these aspects made the application more challenging.

We will be in a good position to apply for the Standard Mark for our next share offer.

How was the target 4% return chosen?

Target interest rates are chosen based on the parameters for each share offer, including the mix of sites (scale of projects), any capital grants awarded, and the site’s current electricity bills.

The share offer aim is to provide energy bill savings whether as a result of lower cost green electricity (solar share offer) or reducing the amount of electricity used for lighting (LED share offer). The financial model needs to work for each share offer’s portfolio of sites.

The interest rate of 4% is aligned with savings account rates at the point at which the share offers were put together. Investors are also aware that some of the returns from the project go to funding Selce’s energy advice service for households experiencing fuel poverty.

Did you consider how 4% compared to other ethical investment options that investors had?

The board direction has been not to try and compete with other investment options, but to focus on attracting people who are keen to invest in local community and to be part of a local just energy transition, while also supporting Selce’s energy advice work.

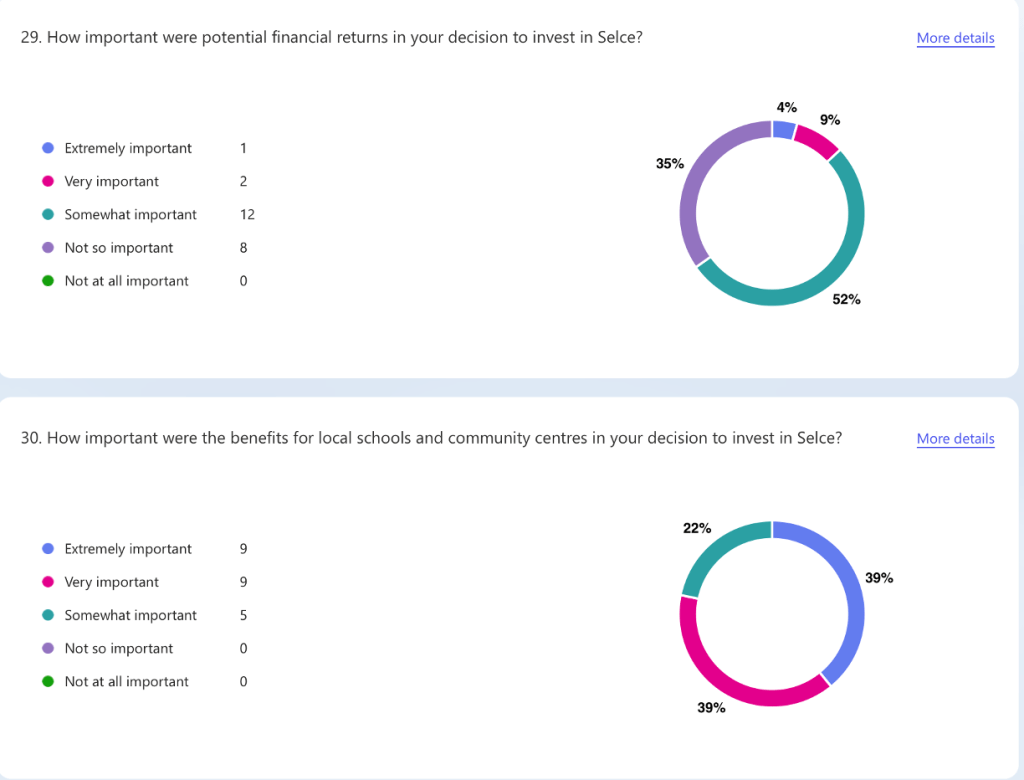

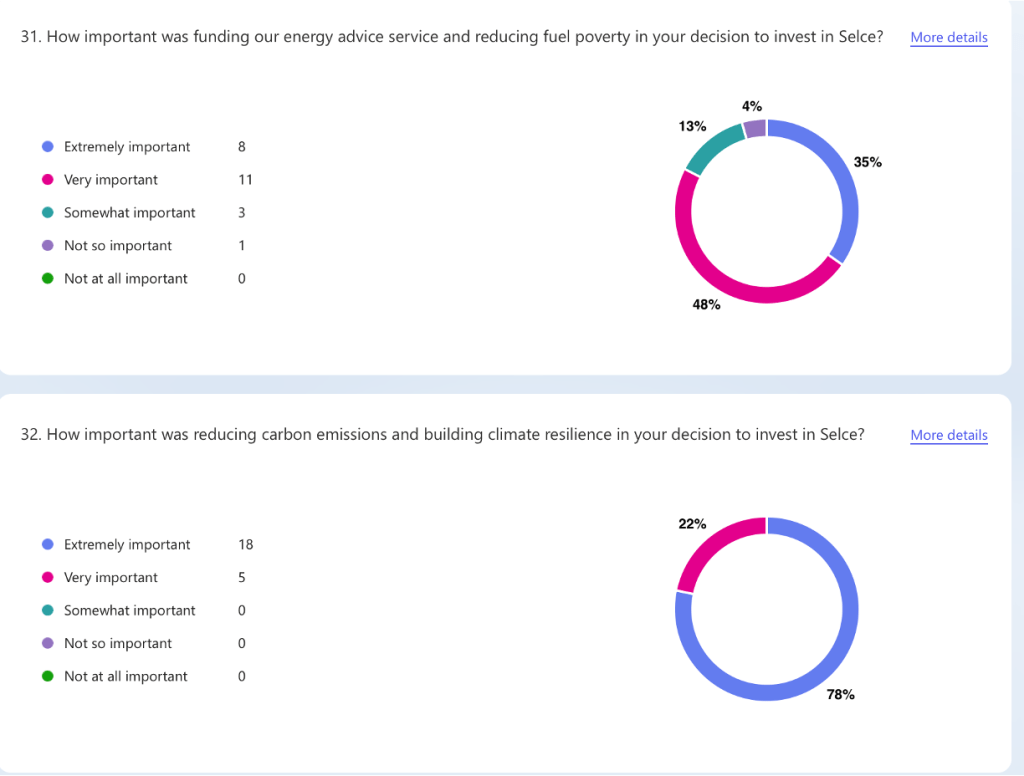

This approach is borne out by the applicants to the 2025 solar share offer, 87% of whom said that investment returns were “somewhat important” or “not so important” in their decision to invest.

Over 80% said that the benefits for local schools and community centres were either “extremely important” or “very important” in their decision to invest.

For the Summer 2024 LEDs offer, what was the thinking behind the 1-6 years idea?

The LED share offer had far less risk as the model is based on building use, rather than sunshine and solar array performance.

Selce’s Lighting Services Agreement provides LED lighting to a site at no upfront cost for a fixed monthly fee. Modelling showed that earlier payback would work, while still allowing sites to save significant amounts on their lighting electricity bills. The intention was that this might attract a wider range of investments, knowing that capital would be returned more quickly.

Did much investment come from the project sites/benefitting organisation?

None based on response from applicants.

Did most investment come from your established network/repeat investors?

For the 2025 solar share offer, some were existing members, with a healthy number of new ones thrown in too. The vast majority were local to South East London.

As for the LED share offer in 2024, just over half came from existing members or recipients of our newsletter.

How did you reach new investors?

For the solar share offer in 2025: via subscribers to our newsletter, our website, social media and two advertorials in the press – one in a climate focused publication, and another in a local magazine.

Alongside this, a very well-run social media campaign. Plus our board making use of their own personal networks.

The share offer launch was also timed to coincide with “Growing the Alternatives”, a green-focused community event run as part of Mayor’s Community Weekend in September, hosted with other aligned local organisations, enabling information sharing and discussions.

For 2024’s LED share offer: similarly, through social media, alongside two public webinars, emails to newsletter subscribers, newsletters from the schools involved, the Community Energy London newsletter, plus Bromley Environment News. We also reached several new investors through the walking tour we organised as part of the London Open House Festival.

What are the best ways to reach new investors?

It requires more research and more thought certainly, but in terms our media sponsorships, the jury is still out. We found more engagement via a publication that was closely aligned with climate action than with a local one. But clearly that is just a sample of two, so we’re not reading too much into it at all.

Even if the former only generated subscribers rather than members in the first instance, this may always develop down the line.

In terms of what our 2025 investors told us, some were new contacts who found us via the Selce website or a search engine, a few via our board and founder’s personal networks and communications.

But the vast majority heard about the share offer via our newsletter, pointing to the value of ‘owning’ your audience, alongside having a presence on social media.

Also, that those who have interacted with your group in the past perhaps, and in person– attended events, received retrofit advice or otherwise met the team – are more likely to have the trust and inclination to invest with your co-operative.

To that end, in future we would plan to host more in-person events and activities to drum up support and reach new investors – an approach I think Croydon Community Energy has used effectively, based on what we’ve seen of their recent share offer.

What was the spread of investment amounts? E.g. A few large investments and lots of small ones? All small ones (£100-300)? All mid-size c£1,000-2000?

For 2025, it was a real spread, with about a third of investments around the minimum £250, but a few higher investments took us to an average of more than £1k.

Even though we had about twice as many investors in 2024, a third were also around the minimum of £250, a third mid-sized, with a spread of higher investments.

Were all investors private individuals? If not, did you have corporate investors?

For 2025, all individuals – for 2024, there was one local branch of an international climate action group who invested. There was also the support from the Green Britain Foundation mentioned above.

Did you have to extend the share offer to reach your target?

For the solar share offer in 2025 we raised the £33,000 amount in around 3 weeks from first promotion.

A dedicated working group met every week for the month prior to launch, then every 2 weeks after launch, to keep track.

For 2024’s LED share offer, a new site came on board part way through the offer which increased our target to the maximum investment target of £58,660.

Launching over the summer may also have made progress slower. There was a campaign re-focus in August on reaching outside of our core followers, and increased press work. In the end, we didn’t need to extend the original end date of 30th September.