Selce’s 6th Community Share Offer is Live

You can also watch the above video directly on YouTube if it’s not working

Invest in Community. Invest in SE London. Invest for a Healthy Return. Invest in a Cleaner, Fairer Future.

💡 Our lighting upgrade project will reduce emissions at the school by an equivalent of around 71,000kg in CO2 over 10 years.

💡 By investing together, there’s so much we can do for people and planet. We are stronger together.

Our share offer document contains all the details you need to know:

Ready to invest? After reading through our share offer document, the next step is to complete the application form:

Invest in Community.

Invest in local – SE London.

Invest in a fair return.

Invest in a cleaner, fairer planet.

We’re raising funds for our 6th community share offer, installing energy efficient, money saving LED lighting at Marvels Lane Primary, Lewisham.

Selce’s previous share offer reached its target in just 3 weeks of promotion – find out our four simple steps on how to invest below:

Key Dates

- Share offer opens: 27 Feb 2026

- Share offer closes: 22 May 2026

Key Numbers

- Share offer target: £39,000

- Minimum investment per member: £250

- Maximum investment per member: £20,000

How to Invest:

1.Read our share offer document.

2.Decide how much you’d like to invest.

3.Complete the application form.

4.We’ll be in touch with info on how to transfer your payment.

…and you’re done!

Share offer to fund energy efficient LED lighting at Marvels Lane Primary School in Lewisham

You are invited to invest in upgrading to energy efficient, money saving LED lighting at Marvels Lane Primary School, Riddons Rd, London

SE12 9RA.

This will be Selce’s 11th community financed LED lighting site.

Replacing 285 lightbulbs as part of this upgrade is projected to save the school £6,725 per year, and an estimated £79,000 over the next decade.

Any project surplus goes to supporting Selce’s fuel poverty alleviation programme.

The more efficient lighting system will also save the equivalent of 7,122kg of CO2 per year.

Based upon our financial model, using the assumptions above, we forecast that we will be able to provide an interest rate of 4%. We will also provide full capital repayment in year 10.

The final decision on the payment of interest is made at the Annual General meeting. If you wish, you may donate all or some of your interest to support our work with families facing fuel poverty. We will contact you annually to ask if you would like to do this.

More Info + Our Installer

Marvels Lane is a two-form primary school in Lewisham, with 404 pupils. The majority of the school’s emergency lighting is linked to a 13 year-old remote emergency lighting monitoring system which is no longer fit for purpose.

In addition to an LED upgrade, this project will decommission the old system and install manual key switches throughout the school, enabling it to conduct more accurate emergency lighting tests at their preferred frequency.

Every year the school sets aside funds for a specific number of pupils, geared towards an activity classified under the enrichment curriculum. Pupils and staff decide on the activity, and reducing their electricity costs will increase the number of pupils able to participate.

Please note that Selce is neither qualified nor authorised to offer investment advice. Those interested in participating should make their own assessment of the offer, should take note of any risk factors described in the documents, and may wish to take independent financial advice. Capital at risk.

Our Installer is Energy Efficient Solutions Group, who have been operating since 2009.

They are a NICEIC registered installer and a Certified B Corporation; selected because of their experience in decommissioning remote emergency lighting monitoring systems, product quality and community engagement element associated with their LED projects.

For more information, please read our share offer document.

Share offer to fund energy efficient LED lighting at Marvels Lane Primary School in Lewisham

You are invited to invest in upgrading to energy efficient, money saving LED lighting at Marvels Lane Primary School, Riddons Rd, London SE12 9RA.

This will be Selce’s 11th community financed LED lighting site.

Replacing 285 lightbulbs as part of this upgrade is projected to save the school £6,725 per year, and an estimated £79,000 over the next decade.

Any project surplus goes to supporting Selce’s fuel poverty alleviation programme.

The more efficient lighting system will also save 7,122kg of CO2 per year In terms of carbon emissions.

Based upon our financial model, using the assumptions above, we forecast that we will be able to provide an interest rate of 4%. We will also provide full capital repayment in year 10.

The final decision on the payment of interest is made at the Annual General meeting. If you wish, you may donate all or some of your interest to support our work with families facing fuel poverty. We will contact you annually to ask if you would like to do this.

For more information, please read our Share Offer Document.

Please note that Selce is neither qualified nor authorised to offer investment advice. Those interested in participating should make their own assessment of the offer, should take note of any risk factors described in the documents, and may wish to take independent financial advice. Capital at risk.

Our last lighting share offer included funding energy efficient LEDs for Glass Mill Leisure Centre – watch the video above for more background (or here on YouTube if the above video doesn’t appear.)

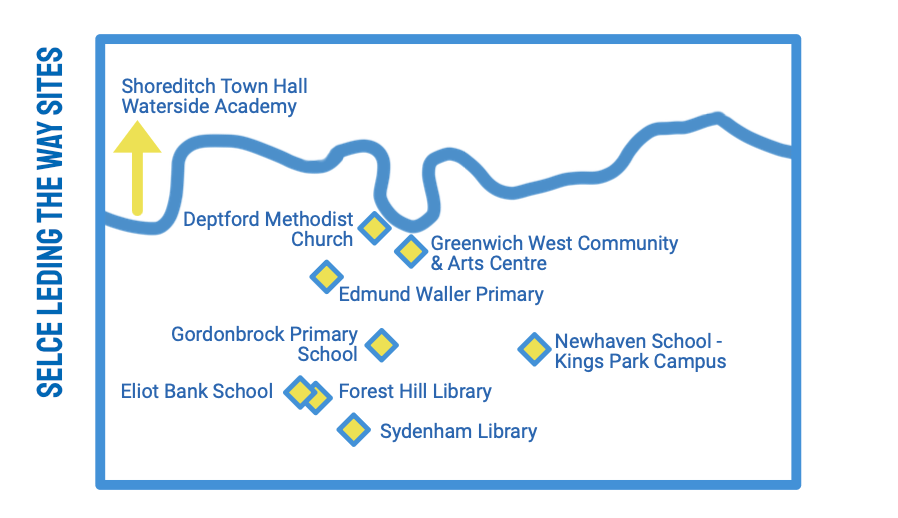

⬇️ Selce has already installed LED lighting in 10 other Locations ⬇️

2 stories of Our Previous LED Lighting Projects:

1. Waterside Academy

2. Edmund Waller Primary

New to community share offers? Read our guide – What is a community share offer

Find out more: Who Invests in Community Energy Share Offers and Why

Key Documents for Members

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.